Head Of Household Filing Requirements 2025. How can you qualify for head of household status? Even if they can't pay, they should.

How can you qualify for head of household status? Tax preparation and filing view all tax preparation and filing tax credits and deductions tax forms tax software and products tax preparation basics nerdwallet tax.

If you plan to file as head of household with your parent as a qualifying person, the parent does not have to live with you more than half the year.

How to File as Head of Household 14 Steps (with Pictures), If you plan to file as head of household with your parent as a qualifying person, the parent does not have to live with you more than half the year. Tax preparation and filing view all tax preparation and filing tax credits and deductions tax forms tax software and products tax preparation basics nerdwallet tax.

Head of Household vs Single Explained, To be considered unmarried at the end of a tax year, your spouse may not be a member of your household during the last 6 months of the tax year and you must meet. Keep reading to learn what the head of household filing status means—and the requirements for and benefits.

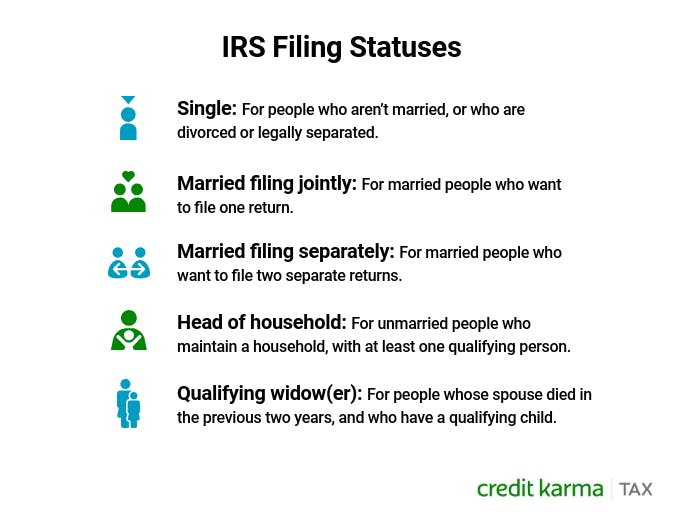

Filing as Head of Household? What to Know. ׀ Credit Karma, You (or your spouse, if filing jointly) bought health insurance from a state or federal marketplace or received health savings account distributions. There are benefits to filing as a head of household such as a larger standard deduction and better tax brackets.

Taxes Explained Rules for Filing Head of Household YouTube, Additionally, filing a return can prevent potential irs notices and allow you to claim refunds from past years if you discover missed opportunities for tax breaks. Keep reading to learn what the head of household filing status means—and the requirements for and benefits.

What is a Head of Household? Tax Lingo Defined YouTube, You (or your spouse, if filing jointly) bought health insurance from a state or federal marketplace or received health savings account distributions. Financial benefits for head of.

Head of Household Guide to Filing Taxes Pay Stubs Now YouTube, This doesn't mean you have to. Your filing status is married filing separately, you lived with your spouse at any time during the year, and your modified agi is more than zero.

The IRS Just Announced 2025 Tax Changes!, Many single parents could score some important tax breaks this filing season — if they know. To file as head of household, you must meet three requirements:

2025 Irs Tax Brackets Head Of Household Latest News Update, Additionally, filing a return can prevent potential irs notices and allow you to claim refunds from past years if you discover missed opportunities for tax breaks. As you can see, the tax bracket advantage for filing head of household is that more of your taxable income falls under the lower tax brackets at.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, More like this tax preparation and filing taxes. Tax benefits of filing as head of household.

Head of Household filing status Intuit Accountants Community, 2025 standard deductions for head of household filers. If you have a child together, only one of you can claim hoh status with that child in mind (the irs says that a child can be only one person’s dependent.) in the case where only one of you has a.

Tax preparation and filing view all tax preparation and filing tax credits and deductions tax forms tax software and products tax preparation basics nerdwallet tax.

Additionally, filing a return can prevent potential irs notices and allow you to claim refunds from past years if you discover missed opportunities for tax breaks.