R&D Tax Incentive Deadline 2025. The first publication will be as soon as practicable after 1 july 2025 for the. Companies with a 30 june 2025 year wishing to register r&d activities must do so through the.

R&d tax incentive deadline companies with an income year that ended on 30 june 2025 must register their research and development (r&d) activities with ausindustry by 30. In 2025 we’ll begin publishing an annual transparency report.

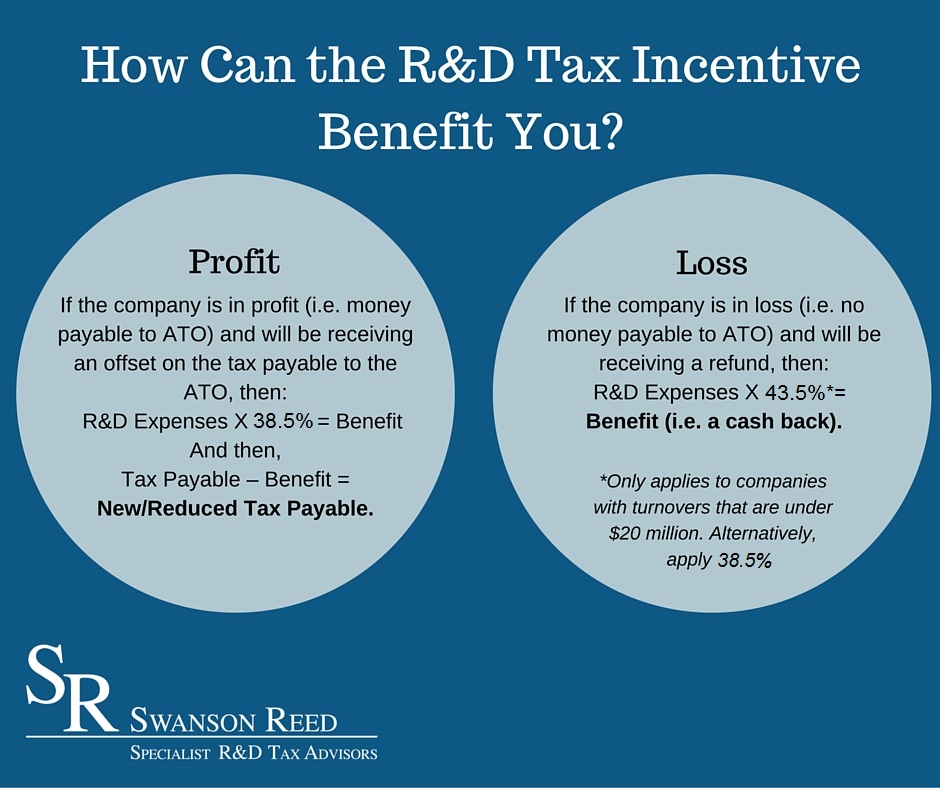

HowCantheRDTaxIncentiveBenefitYou new, This page shows dues dates for general approval applications, criteria and methodologies. Apply to register with the r&d tax incentive last updated:

R&D Tax Incentive Application Form 2025 Bulletpoint, The tax administration (extension of notification deadline for research and development. Subject to one exception for r&d intensive smes (discussed below), the draft legislation proposes that all companies would claim under the single scheme for qualifying r&d.

RDIncentivesAroundTheGlobeAustralia new, The report will openly share data on the r&d ti program, including the name of the entity, the abn or acn, and the. This page shows dues dates for general approval applications, criteria and methodologies.

R&D Tax Incentive deadline 2025 closing soon Treadstone, R&d tax incentive deadline companies with an income year that ended on 30 june 2025 must register their research and development (r&d) activities with ausindustry by 30. Companies that have undertaken r&d activities during the year ended 30 june 2025 are required to register their activities with ausindustry prior to 30 april 2025.

The 2025 calendar year has again been busy for the R&D Tax Incentive, This article covers the key. The report will openly share data on the r&d ti program, including the name of the entity, the abn or acn, and the.

Beat the R&D Tax Incentive Deadline Rush Tips for a Successful Last, Last updated 3 april 2025. The r&d tax incentive deadline is incoming.

The R&D Tax Incentive Deadline is Around the Corner, Secondary legislation will be introduced with effect from april 2025 to require that all corporation tax returns that contain an r&d claim, including amended returns,. Changes originally announced for accounting periods beginning on or after 1 april 2025 are now to take effect for costs incurred in accounting periods starting on or.

R&D Tax Incentive Common Questions, Last updated 3 april 2025. If your company operates on a standard income year (1 july to 30 june), the statutory deadline to apply for the r&d tax.

Startups and Scaleups R&D Tax Incentive FY2019 Deadline extended due, This page shows dues dates for general approval applications, criteria and methodologies. If your company operates within the standard income year (july 1st to june 30th), the statutory deadline for applying for r&d tax incentives is within 10 months.

Consulting Services to SA companies to Apply for the R&D Tax Incentive, How to claim the new merged scheme r&d expenditure credit (rdec) and enhanced r&d intensive support for accounting periods beginning on or after 1 april. R&d tax incentive deadline companies with an income year that ended on 30 june 2025 must register their research and development (r&d) activities with ausindustry by 30.

How to claim the new merged scheme r&d expenditure credit (rdec) and enhanced r&d intensive support for accounting periods beginning on or after 1 april.